✅ Dave Ramsey’s baby steps (UK version)

If you’re looking to secure your financial future, Dave Ramsey offers a step by step guide to transforming your finances, and could take you from ‘in-debt’ to debt free and financially secure in 7 steps.

I'm Steph, mum of three! 👋

Here, I share practical insights on making (and saving!) money. With a knack for budgeting and a passion for financial freedom, I've picked up lots of tips & tricks along the way. And I can't wait to share them with you here!

The original Dave Ramsey baby steps are geared towards the US and some of them are not as relevant to us here in the UK, so we’ve adapted them slightly to reflect the UK.

✅ Dave Ramseys baby steps (UK version)

- Baby Step 0 – Create a budget

- Baby Step 1 – Create your emergency fund

- Baby Step 2 – Pay off all your non mortgage debts

- Baby Step 3 – Save a fully funded emergency fund

- Baby Step 4 – Invest in your pension

- Baby Step 5 – Fund your children’s education

- Baby Step 6 – Pay off your mortgage

- Baby Step 7- Invest

✅ Reviews of Dave Ramsey’s UK baby steps

If you know Dave Ramsey and his philosophy, you’ll know how many people he’s helped to get out of debt. But for the people who haven’t heard of him and are researching the best ways to get out of debt, I thought it would be helpful to give you a little ‘Dave’ background.

In a nutshell, Dave Ramsey is an American TV personality / financial guru who helps people get out of debt. He calls the steps he uses to get debt free ‘baby steps’.

There are 6 baby steps in Dave’s debt free plan, but that really is if you’re an American living in the US. A lot of people in the UK who follow Dave Ramsey choose to skip baby step 5. This step is aimed at saving for your children for college. Although this is a great thing to do, the funding in the UK for university is set up totally different to that of the US, so many people don’t do this.

If you wanted to though, you could easily do it for a house deposit or similar though.

✅ Dave Ramsey’s UK Baby Step 0 – Create a budget

Baby Step 0 – Get current on all your debts, so none are in arrears.

You need to commit to NOT taking on any more debt.

Start the Dave Ramsey UK baby step 0 by getting up to date on all your bills, you’re starting this on an even playing field.

If you’re behind on your council tax (we’ve been there!) the budget you’re about to write out is not going to be a ‘true’ picture of your monthly finances, as you’ll be having to spend more of it than you should catching up, where you’re behind.

Do whatever you have to to get on top of yourself with your bills. Coming to agreements with the council, or whoever you owe money to (that’s a non credit debt) is okay when there’s no other way around it, but if you’re committing to the baby steps, you need to get current.

✅ Dave Ramsey UK Baby Step 1 – Create your emergency fund

Baby Step 1- Start an emergency fund. Save £1000 in a fund for small emergencies.

If you’re on Dave Ramsey’s baby step 1, you’re going to be spending the time in this step getting your Emergency Fund together. The point of this emergency fund is that you’re not going to be ‘borrowing’ to pay for those emergencies anymore.

Things are going to happen. Cars will go wrong, washing machines will break and, in my case, dental fillings will need replacing. But you’re going to have the money to cover them and honestly? It’s an amazing moment when you realise you can cover whatever expense it is, without having to add more debt to the stack you’ve already got.

Dave Ramsey says you need $1000 so of course it’s generally accepted in the UK this simply translates to £1000. Is £1000 enough? It was for us, and if you dip into it as we did a few times, you stop your snowball and get straight back to building up your fund again to £1000.

✅ Dave Ramsey UK Baby Step 2 – Pay off all your non mortgage debt

Baby Step 2 – Pay of ALL debt apart from your house.

Using the Debt Snowball debt repayment method. Dave Ramsey UK baby step 2 is all about clearing ALL your non mortgage debt.

Dave says we have to also pay off our student loan debt. I did not. UK student loans are totally different to those in the US, and it is NOT always beneficial to pay them off.

Martin Lewes of Money Saving Expert explains why in this article. It’s one of those things about Dave Ramsey that differs from country to country. In the US, I agree whole heartedly, but not in the UK.

The Dave Ramsey baby step 2 way is the Debt Snowball. I used this method along with 5 million other people, and I can tell you, it works. You list all your debts from smallest to largest, then start by paying off the smallest.

Once the smallest is paid off, your going to take that minimum payment and add it to the next smallest, and keep going until you’re debt free.

✅ Dave Ramsey UK Baby Step 3 – Save a fully funded emergency fund

Baby Step 3 – Save 3-6 months worth of expenses.

You’re debt free (except the house) but not secure for the future. Dave Ramsey suggests 3-6 months of emergency fund and I think this is reasonable.

If you happen to have a particularly good redundancy package you could go for 3 months expenses.

The rest of us? 6 months is really where you want to aim for. This is scary. At least it was for us.

Most (all?) of my adult life I’ve been in debt of some sort. I’ve never had any savings, so the thought of saving up SIX MONTHS worth of salary was huge. BUT…and I think this is really important, it’s 6 months of savings that would literally ensure you ate and had a roof over your head, rather than 6 months of living as you are now.

This is NOT the time to be including city breaks in your monthly budget or thinking about upgrading your car.

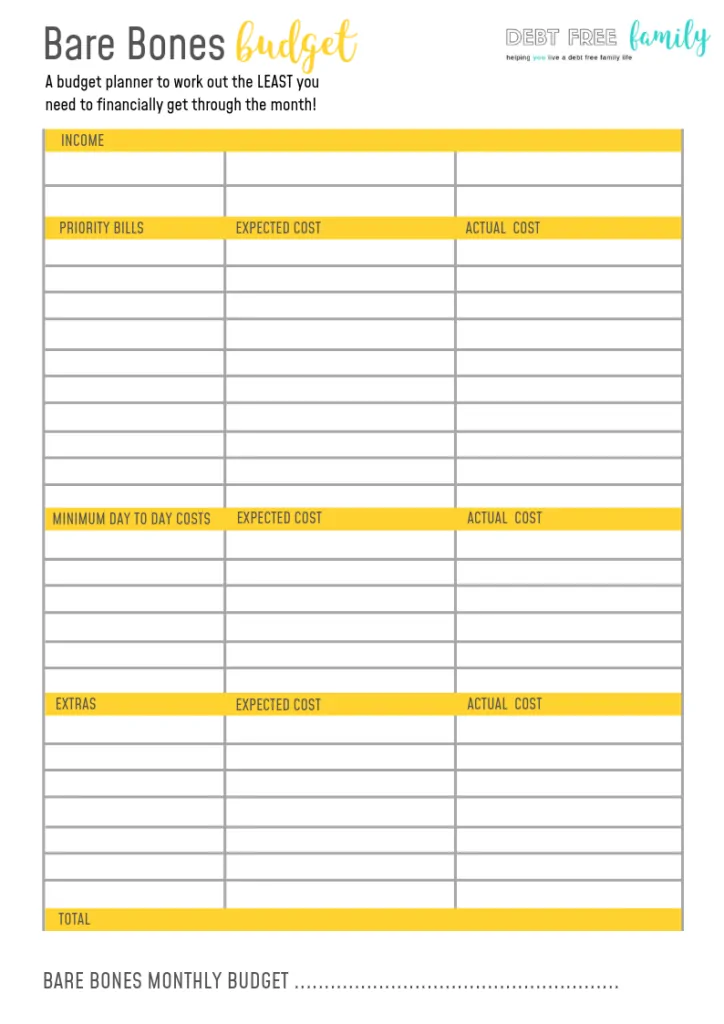

This is the Bare Bones of expenses. Use our budgeting sheet here to figure out what the VERY least you could survive the month on would be. For us, it was about half our monthly income (remember you’ve got no debts to repay now!).

✅ Dave Ramsey UK Baby Step 4 – Invest in your pension

- Invest 15% of household income for retirement. Not started saving for retirement yet? Now’s the time! You’re debt free, you’ve got surplus money from not having to make the debt repayments, so here’s where you start to build up your retirement fund. You’re going to be relying on the power of compounding and that needs time which is why Dave says to do this NOW!

✅ Dave Ramsey UK Baby Step 5 – Save for your children’s education

Save for children’s college (optional if in the UK) – we didn’t do this. See above!

✅ Dave Ramsey UK Baby Step 6 – Pay off your mortgage

Pay off your home early through overpayments – we’re not here yet. This is the dream :)

✅ Dave Ramsey UK Baby Step 7 – Invest & give

This is the stage where you’re totally debt free with a fully funded emergency fund to see you through any tough times. Invest? For sure. Give? Yep….Dave Ramsey does this through the church…if that’s not really your thing, there are lots of other ways to give back to your community!

✅ Free Dave Ramsey UK Printable’s

We used these printable’s on our debt free journey and know they’re really helpful

We called this one our Bare Bones budget sheet simply because we’d stripped everything right back to basics so we could save as much as we possibly could.

We found that so many of the things we thought were ‘essentials’ just were not. It was about being honest with ourselves and actually asking the question…”what will happen if we don’t have this?”. The answer? Nine times out of ten, nothing was going to happen!!

I’ll be upfront about this….i’m not one for colouring! But…..I do see the positives in a simple progress tracker, so this honeycomb one came everywhere with me, tucked away on the inside of my weekly planner, reminding me when I needed it that we WERE making progress no matter what it felt like. I just didn’t want it on the fridge :)

P.S There are approximately 200 honeycombs!

✅ Top 5 Tips For Success with Dave Ramsey’s UK Debt Free Method

1. Use the cash envelope method to budget

Using cash to budget means you’ve accounted for every penny, and know where you are for the month.

Before you get paid, write out a budget and give every penny a home, so set aside money for food, bills, entertainment, fuel etc… and once this is done, and you know you’ve got enough to last, don’t spend a penny more!

You’re FAR less likely to overspend if you know where every penny is going. Read our post on cash budgeting here to get started!

2. Earn more money

Seems easy when you put it like that right? Well…it’s actually not as hard as it first seems.

We don’t all have thousands to throw at our debts when we’re in baby step 2, but there are lots of ways to bring in a little extra cash when you need it.

Have a look through our posts on making extra money to get some ideas to boost your income!

3. Pack your own lunch

Taking your own lunch to work five days a week can save upwards of £780 a year, and that’s if you only spend £3 a day on lunch. Lots of us spend a lot more than this!

Make a little extra dinner and have the leftovers for lunch the following day. Likely to be healthier, it’s a win win situation!

4. Stop buying coffee out

I don’t mean always, no. I’m a big coffee fan here and I LOVE going to sit quietly in a coffee shop…just not everyday!

Use discount vouchers when you can, use loyalty cards to get free coffee and simply cut back a bit!

Nero’s and Costa both have good loyalty schemes to get free coffees and McDonalds coffee is half the price of high street coffee shops, but is still ground coffee.

5. Buy preloved

Secondhand clothes, furniture and other bits and pieces are often as good as new for a fraction of the price.

Once you’re in the mindset of paying off your debts in Baby Step 2, paying over the odds for items becomes quite painful! Don’t go without though, go preloved instead!

Baby step 1 is where you gather £1000 as a small emergency fund to cover any unexpected expenses that arise before you’re debt free.

Baby step 2 is where you pay all your non mortgage debts off. So that’s credit card, loans, car payments, student loans, and anything else you owe, apart from your house.

Here’s where you save for you fully funded emergency fund. That’s going to be 3-6 month’s worth of expenses.

Investing for your retirement. 15% of your income (remember you have no debts to repay!) needs to go towards security in retirement.

Savings for your children, if you have any. This step is often skipped in the UK as we don’t have to pay upfront for college education.

Overpay your mortgage and get rid of your home-loan. The ultimate debt free goal….owing your home outright!

Need some more Dave Ramsey inspiration?

(and here’s our post on exactly how WE’RE going to save a Million!)

And if you’re still wondering if being financially free can really change your life, Eileen, from blog Your Money Sorted, has a pretty awesome post here that might just convince you!

Do you have any other tips you think might be helpful to other people? Share them in the comments below :)

Previous posts you might like

Questions about the baby steps? Leave me a comment below and I’ll do my best to help you!

Hi there,

Thanks for your question. Dave Ramsey suggests that the 15% should be of your money, so no, don’t count your employers contribution. Hope that helps!

Steph

Is the 15% into your pension including any payments you get from your employer and work benefits or on top of this?

Thanks

Morning Lara!

Thanks for your comment. Do let me know how you get on with Dave Ramsey and in case you missed it we’ve got a free app that helps you track your repayments, you might find useful!

https://apps.apple.com/gb/app/debt-snowball/id1455375883

Thanks

Steph

Thank you. I was looking for the UK equivalent. This really breaks it down for us. xxx

hey, thanks for this. starting this week, so looking forward to it

Fab post… Dave also says if your income is under $20k it’s $500 step 1 this helped me