✅ How to budget money UK

Struggling with how to create a budget? We can help!

I'm Steph, mum of three! 👋

Here, I share practical insights on making (and saving!) money. With a knack for budgeting and a passion for financial freedom, I've picked up lots of tips & tricks along the way. And I can't wait to share them with you here!

If you know full well you need to make a budget and stick to it – you’re not alone. Our full guide to household budgeting tips will help you sort your finances!

You know you need a budget. You really need a budget. But you’ve never done one before, or maybe you tried and it didn’t work out so you let it go…I hear you!

I’m happy to tell you that budgeting for your family doesn’t have to be hard or daunting: it can be easy and freeing. The worry that comes with not knowing where your money’s going each month will lessen, along with the stress of wondering if you can afford your car repairs.

Looking for the best UK budgeting apps? Read our post here!

Think budgeting’s boring? It’s not not nearly as boring as worrying constantly about money.

Let us show you how to create a budget for your family. It’s the very first step towards financial freedom!

✅ How to stick to a budget UK

The thought of making a monthly budget scares people. I used to be one of them. I didn’t really understand what I needed to do. I worried that because we didn’t have a lot of money, seeing it on paper would somehow make things worse. Stupid, I know, but I didn’t want to face it.

✅ Setting a financial goal can give you motivation to budget. Knowing your goal is within reach if you budget, makes it less of a chore

The reality of a budget is that is can be as simple or as in depth as you like. All it really is, is an expenditure sheet. What’s coming in and what’s going out.

If you’re short of money, or even if you simply get to the end of the month and have no idea where your moneys gone, a budget will show you where you can make savings. It can clearly show you where you need to be bringing in some more money, and if you’re able to start putting a little money aside each month.

Your budget will become a way for you to see the bigger financial picture.

✅ Budgeting tips for beginners

Put simply, everyone needs a budget.

Without a budget, it’s really hard to know where you’re at with your money. We all want our money to last us to the end of the month and we expect that our money will do certain things for us: pay for the food shopping, pay the bills etc…but without knowing what’s coming in and more importantly, what’s going out, how can we be sure it’s going to last?

Well…..unless you’ve got so much coming in that you expect never to run out, we can’t!

✅ Ever wondered where your money goes? Creating a budget is the fastest way to find out!

When I finally sat down and started our budget, I realised two things very fast. Firstly, it forced me to see that all the ‘little’ things I was spending were really adding up. And secondly, I discovered I loved having some rules on place around our finances.

If you’ve ever found yourself wondering why you run out of money mid month, or going into your overdraft just to buy food, a budget can help you out. Or if you long to get some savings behind you, a budget can help you do that.

Budgeting is a way to get you financially where you want to be. If you’re not making one, you’re missing out!

✅ Help with budgeting money

Monthly budgets are the most common, although as we said above, weekly budgets can be better depending on your income.

So, how do you go about creating a budget?

Create your budget before the month starts and then:

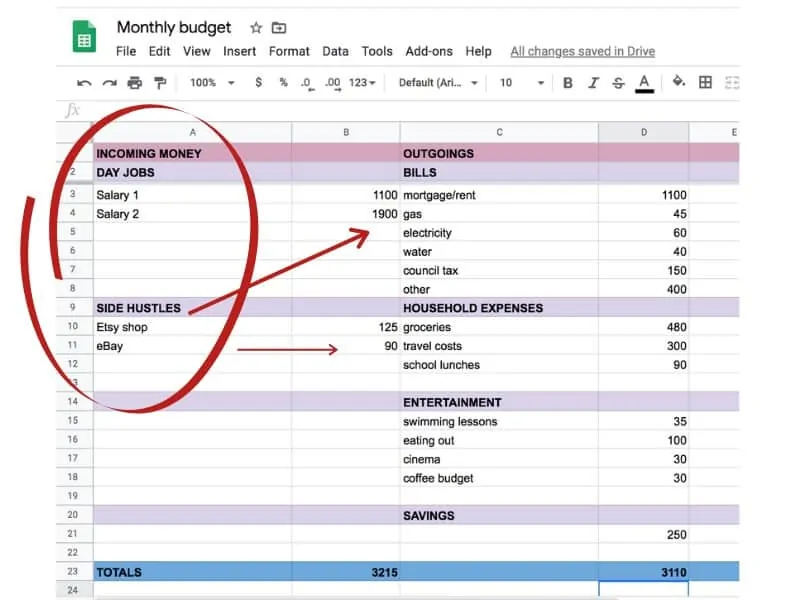

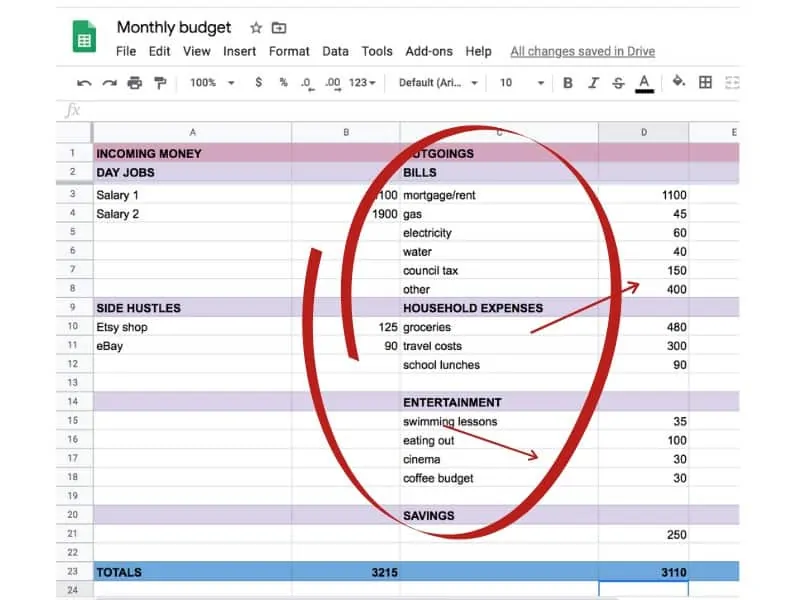

Identify all the money you have coming in

Make a list of all the money you’ve got coming in. Selling online, everything, and always underestimate rather than over, then you won’t get any nasty surprises!

List all your monthly expenses

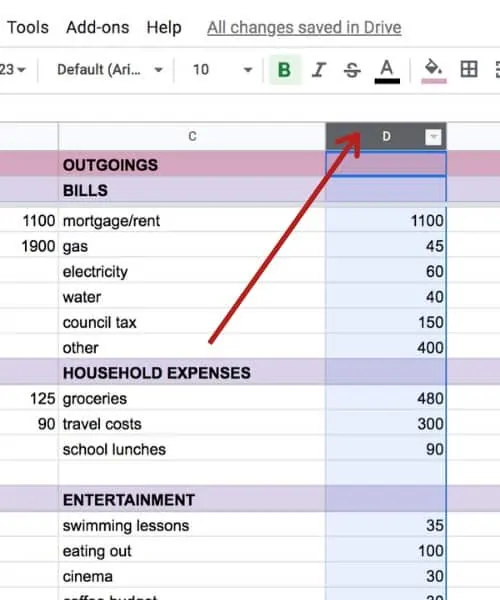

Next, you need to enter your monthly expenses. Start with the fixed, non negotiable ones like your rent and your household bills. Enter everything in, and go over last months bank statement to make sure you’ve not forgotten anything.

For expenses like food shopping that can change week on week, come up with a realistic amount you’re not prepared to go over….and stick to it!

As you can see, I add in everything to this. Entertainment (read: my coffee budget!) and the kids classes when the took them.

Some people have a separate column for their entertainment budget, so do whatever works for you. The main point is that you can see all your outgoing in front of you, in black and white.

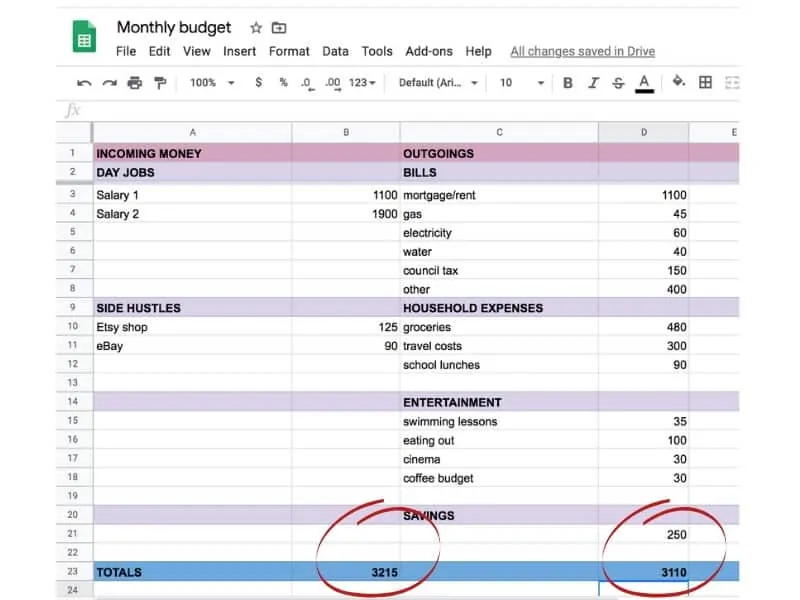

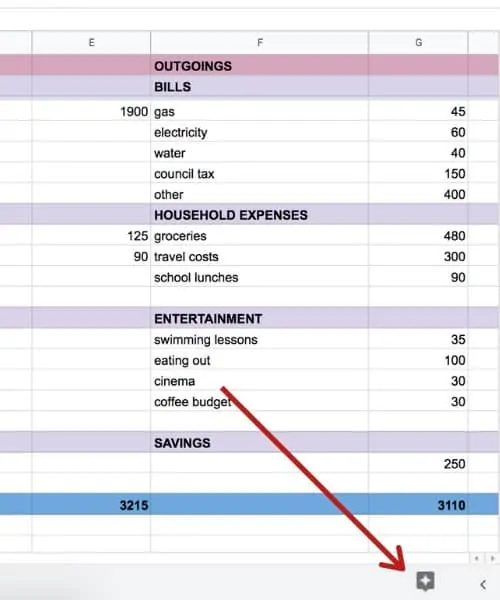

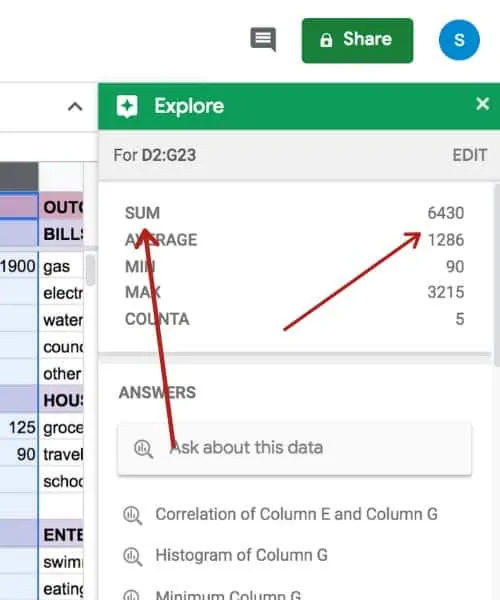

Next, you’ll want to add up the columns. The incoming money’s probably pretty straight forward to total. The outgoing column, not so much! Luckily, there’s a quick, easy way….

So now you can easily find out the total of your budgeting columns.

By the time you’ve reached this point in your budget, you can see the difference between your incoming money and your outgoings. Hopefully there’s more coming in than going out but even if there’s not, at least you can now adjust your budget, make changes and see where you need to make cut backs.

✅ Zero based budgets are recommended by Dave Ramsey. Giving every penny a home means you can finally make it through to the end of the month!

In the example above, there’s a positive difference of £105. Really, you should budget every last penny of your money each month. This is known as a zero based budget and you can read about them here. By giving every last penny a home (even if it’s to savings, which is great!) you won’t ever again wonder where your money went. Honestly, it’s a good feeling.

Create an emergency fund plan

Until not very many years ago, the idea of having an emergency fund was lost on me. We earned money, we spent it.

It was really that simple.

Of course, like everyone, we still had the usual emergencies come up, the car/washing machine etc… breaking down, and every time this happened, we’d flap and try and scrape the money together, usually borrowing from somewhere or credit-carding it. And then we discovered the total joy of having an emergency fund.

As per Dave Ramsey, I’d recommend getting an emergency fund together as soon as possible. We started with £1000 and kept the fund at that level while we paid off the rest of our debts. £1000 is enough to deal with most of the everyday things life throws at us.

Put aside as much as you can afford.

My best tip? Set an amount you want to save before you start your budget and make it reasonable. If you wait until everything’s been paid to see what you can afford to save, the answer will always be…..zero. Setting an amount you want to save each month means you work your budget around your savings. Pay yourself first, not last.

✅ How to budget on a low income

Living on a low income makes creating a budget for your family pretty much essential.

In some ways, a low income budget is the same as any other in that you need to know what comes in, and what goes out. That said, if you are on a low income, I think seeing where I could use a little more money and where I can save some cash even more important than usual. And it’s amazing the places money goes that we don’t realise until it’s right in front of us.

Living on a tight budget tips

There are a few things you can do to help you budget when things are tight:

- Budget weekly instead of monthly – a month can be a long time. A week, on the other hand, goes fast and so it’ll never seem like long until you’re at the start of a new budget!

- Set aside an hour a week – low income budgets require some creativity. Give yourself an hour every week when the kids are quiet to find new ways of saving money on food, collecting coupons and making sure you’re getting the most out of every last penny

- Keep setting goals – we all need goals to work towards and living on a low income isn’t a reason not to have a goal. Keep working towards yours, no matter how slowly, it’s amazing how fast money can add up with a little focus!

Spend less on food

In our house food is one of the biggest monthly expenses, much like many homes across the UK. There are 5 of us for a start, and we we get through a fair amount of food.

When I started a monthly budget and it became clear we needed to cut back our food bill, there were two things we did that made the biggest overall difference, and we managed to cut our grocery bill by a third. A third. That was huge for us and meant we could out that money to work elsewhere.

Plan your meals for the whole week: breakfast, lunch and dinner

So many people talk about meal planning and yet so few of us actually do this week in, week out. And yet it’s singularly the best way to cut your food bill (not to mention eat healthier meals).

Every week I plan out all our food, 3 meals a day, including packed lunches if they’re needed. I put our meal plans on the fridge, and everyone knows what we’re having to eat. Now the kids are older they’re in and out more but smaller kids love to help out with this, and if they’ve helped out, they’re more likely to eat it…:)

Making a meal plan each week also means I started to batch cook, and batch cooking allows you to bulk up a meal for far less than the cost of cooking another whole meal from scratch, so you get 2 family meals for barely more than the cost of one.

My Fussy Eater has some great batch cooking recipes here!

The second way to save money on food? Use supermarket money saving apps. You’re buying food anyway right? Did you know there are apps that will let you upload your receipts and claim money back for the things you’ve already bought?

There are a few apps available in the UK including the ones below.

- Receipt Hog

- Shoppix

- CheckoutSmart

- Shopprize UK

- SnapMyEats

- GreenJinn

You can read our full post on apps that pay for your receipts here!

Don’t forget to make the most of supermarket loyalty schemes when you’re doing your grocery shopping either. However, always go for the cheapest place to buy your food and don’t shop there just because of their loyalty scheme.

How to live on a budget and save money

Trying to save money whilst on a tight budget can seem like asking the impossible. When things are tough saving can feel like the last thing you’re able to do.

However, saving in this situation isn’t impossible. The first thing you need to do is be realistic. Set small goals that will help you achieve your bigger goals. Instead of deciding to save for a trip round the world cruise, perhaps create a goal to get debt free first. Or pay off any utility bill arrears you have by the end of the year etc…

Creating small goals you can win easily will give you more motivation to keep going than facing a huge goal you can’t see yourself ever achieving.

I’m a big advocate of the Dave Ramsey way of paying off debt.

You can read about the way he suggests to get debt free here.

Living well on less money

5 ways to live well on less money

- Could you buy it preloved? Before you buy anything, ask yourself if you could get it secondhand. Some things you’ll get easily, some you won’t. But instead of going without, secondhand might be better

- Get healthier (and save cash). Can you ride your bike instead of driving to the shops? Use the free park gyms instead of a gym membership? So many things we do without thinking have a free (or at least cheaper) alternative

- Ditch your phone contract. As soon as you’re out of contract, instead of upgrading, go for a SIM only deal instead. Your phones likely to be good for another year or so and the cash you’ll save can be in excess of hundreds of pounds a year.

- Swap takeaways for fakeaways. Healthier and cheaper, fakeaways are just as delicious as takeaways. Pinch of Nom has some of the most delicious I’ve found!

- Know your library. Free storytime for the kids? Free IT classes? Your library is SO much more than just books. Although the books are a good enough reason alone…:)

✅ Budgeting tools

There are many tools available to help us budget. They range from simple free budgeting templates to highly detailed budgeting software. My suggestion? Start simple. There’s really no need for a family household budget to be made super complicated and hard. The simpler you make it, the easier it’ll be to get into the habit of doing it each month and it can become something that’s quite easy and even…enjoyable, not something to dread.

The sort of tools you use to make your budget depend entirely on your personal taste. Me? I love a pen and paper. I do also now use a spread sheet, but this is as well as my planner. There’s something about paper I cannot replace, even though I know it’s not the best solution. Use what works for you.

✅ Household budget planners

If like me, you’re a pen and paper type of person, these are some of my best choices. I like things to look good to me visually, and I prefer seeing numbers written down. I use a dedicated budgeting book, which is a step up from my original piece of scrap paper!

✅ Free printable budget planners

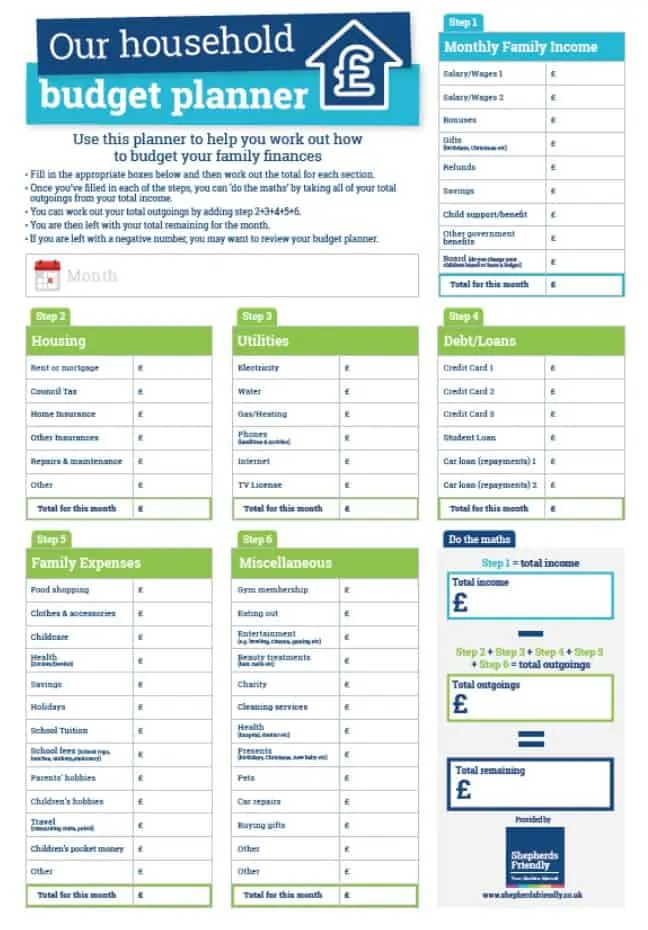

The internet is chock full of free budget planner templates. If you don’t fancy a budgeting book, then these templates can give you a really good printable template to work from.

If you’re going to use these printable’s, it’s a really good idea to get a folder to keep them all in. I look back at previous months budgets all the time to see where I made savings and what I was spending and when.

Don’t forget also, if you can’t find a budget planner to download that suits you exactly, they’re quite straightforward to make if you’ve got a spreadsheet program. (In the example budget above, I used Google Sheets, free to access through Gmail).

These budget planners are a small selection of what’s available online.

This is a simple YouTube tutorial here on creating your own budget planner in Google Docs. It’s simple to follow!

Shepherds Friendly also have a really good budgeting planner you can download for free.

Read our full post here on the best budgeting apps UK